Startup guru and author of The Startup Owner’s Manual, Steve Blank wrote a great blog post this week on raising money titled “Fund raising is a means not an end” and I couldn’t agree more. I worry about this increased focus on raising money over building a sustainable business – for both for-profits and not for profits. The education-oriented endeavors are particularly at risk due to less scrutiny of their business models because there are so many problems that need solving and we are all eager to find solutions given how high the stakes are.

When it makes sense to raise seed capital and/or scale-up capital, Steve suggests a simple test for entrepreneurs:

Here’s a simple test: If you’re the founder of a startup, go to a whiteboard and diagram how a VC fund works. How do the fund and the partners make money? What is an IRR? How long is a fund’s life? How much will they invest in the life of your company? How much do they need to own at a liquidity event? What’s a win for them? Why?

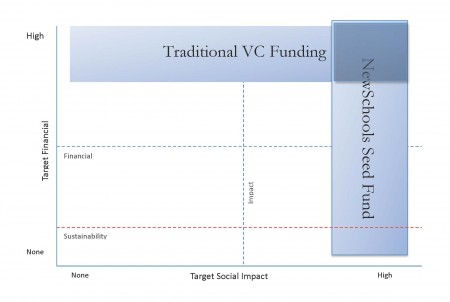

At NewSchools, we target social impact. Traditional VC’s are structured to target financial returns because they have a fiduciary responsibility to their limited partners (funders). An example of a limited partner is a state employee pension fund helping to secure and grow retirement funds for teachers or nurses. As the chart below shows, NewSchools will overlap with traditional VC when highly scalable, high-margin and capital efficient companies are solving major pain points in K-12. These types of companies go on to raise Series A financing from traditional VC. We already have several of these in our seed portfolio. More often, our portfolio companies will either reach sustainability on customer revenue through seed capital alone or will raise their follow-on financing from non-traditional venture funding sources such as large family foundations, social venture funds, education-focused funds and pooled angel capital. Multiple and diverse sources of capital are important to the health of this growing ecosystem.

I’m eager to talk more about this subject next Thursday at the SF Edtech Meetup: