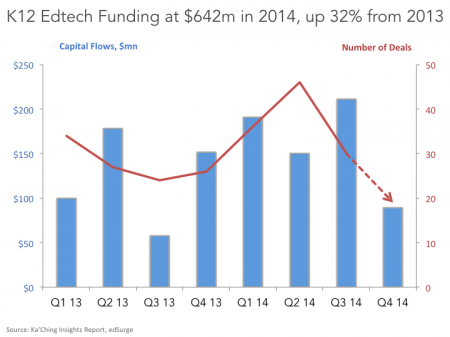

Bolstered by a strong Q1 and Q3, venture investment in K12 education technology was up 32% in 2014 totaling $642 million (data provided by EdSurge). The top ten investments accounted for over half the funding featuring large rounds in Desire2Learn, TeachersPayTeachers, Remind, and Clever. The NewSchools Seed Fund led and/or participated in twenty early-stage K12 edtech deals this year and reviewed over three hundred others.

Here we share our annual analysis of K12 edtech venture funding with emphasis on several key trends in current funding dynamics and investment areas. Please note that in this analyses we do not include companies exclusively focused on higher education nor do we include corporate training, both of which represent areas of significant interest for venture capital. Our focus is on companies serving the preK-12 demographic- both inside and outside of schools.

Current Funding Dynamics

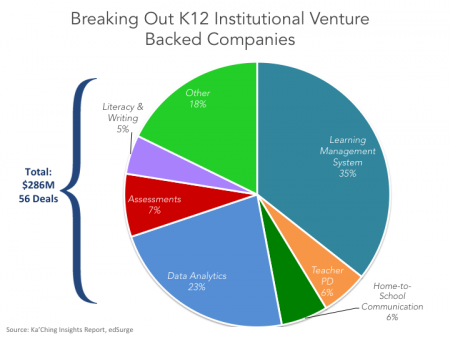

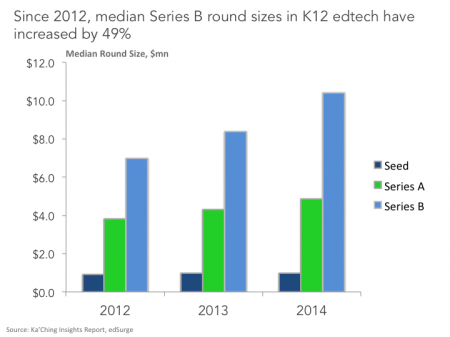

Increasing presence of Traditional Venture in K12 edtech: In years past, venture capital investment in education technology has primarily focused on higher education (e.g. Coursera, Chegg) and consumer-facing companies (e.g. Duolingo, Lumosity). With its long sales cycles and entrenched incumbents, venture capital investors have avoided K12 considering it too challenging of a market to penetrate. In 2014, we saw several of Silicon Valley’s top-tier venture investors make their first K12 investment in over a decade in companies demonstrating strong user growth (e.g. Remind, Edmodo) or modern infrastructure platforms (e.g. BrightBytes, Clever). Their increased and/or renewed participation has been a driving factor in the growth of Series A and B round sizes (relative to Seed).

Freemium is Moving Mainstream (or Rise of B-to-Any): The distinction between institutional (selling directly into schools) and consumer business models (selling directly to parents, teachers or students) in K12 edtech has become increasingly porous as more companies offer options for both free / low-cost teacher adoption and premium site / district-wide licenses. This freemium institutional model is not without its challenges, but several companies have found success by offering compelling, cost-effective premium features such as onsite professional development or by leveraging data on free usage to encourage the institutional sale. Umang Gupta author of Oracle’s first business plan, made a very compelling case for freemium SaaS path for edtech companies here and Jennifer Carolan explains the benefits of a freemium approach here.

Investment Areas

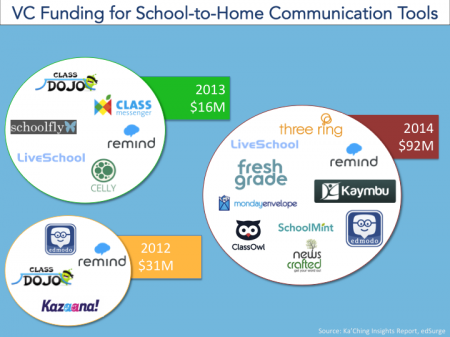

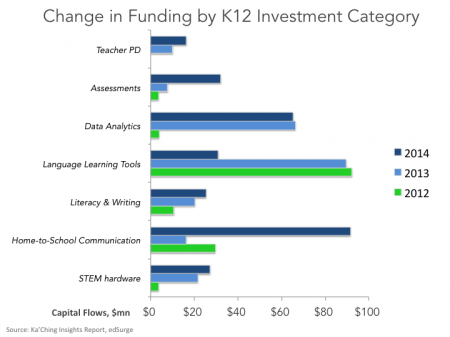

Home-to-School Communication Platforms: There is a revolution underway. Driven by smartphone growth, the way in which educators share information about a student’s progress with parents is changing. The wedge of this disruption is text-messaging and photo-sharing apps, enabling quick and easy ways for teachers to share snapshots of learning or logistical information. Parent engagement data coming from mobile-first apps like ClassDojo, Remind, Freshgrade, Zeal and Kaymbu is an order of magnitude greater than what we’ve seen previously in the parent communication space. These fast-growth platforms will give way to disruption in other areas such as assessment, social-emotional learning and homework support. We consider the unprecedented growth of mobile (mainly communication at this point) apps in K12 to be one of the most significant trends of 2014 and importantly, is helping to close the “other” education gap–the gap between parents and the classroom. Alex Hernandez put it best when he wrote, “design solutions for families. Help us become equal partners in supporting our children’s learning.” As of the writing of this article, home-to-school communication platforms have raised $92 million in venture funding in 2014.

Venture funding for language learning tools is down substantially: In 2012 and 2013, venture funding in language learning tools accounted for a substantial portion of total funding in the space (21% and 18% respectively). In 2014, this figure is down 65% at $31 million and accounts for just 5% of the total funding in K12 edtech. While this remains a large and growing market, capital is remaining patient as popular free offerings such as Duolingo proves out the potential to tap into enterprise sales.

Funding for data analytics tools remains strong at $65 million: Data products continue to perform strongly as schools demand more sophisticated tools to support decision-making around student achievement and resource allocation. This year, we observed two important trends in K12 data use: a) the expansion of data tools beyond the traditional LMS and into new areas such as helping schools better assess student performance/readiness (Equal Opportunity Schools, Ellevation), b) the use of data to un-silo schools by providing administrators with relevant benchmarks and expected return from school spending (Decision Science, BrightBytes). Moving forward, data will remain a relevant storyline as states rollout the first generation of Common Core assessments.

Looking Ahead

While funding continues to grow in K12 edtech, many of the companies are relatively early-stage. Gaps in the market exist and attractive opportunities remain. In particular, we would like to see more innovative solutions in collaborative technology tools, special education and project-based learning curricula.

Special thanks to Jennifer Carolan, Shauntel Poulson and Vivian Wu for feedback and guidance. Data made available from EdSurge Reports.