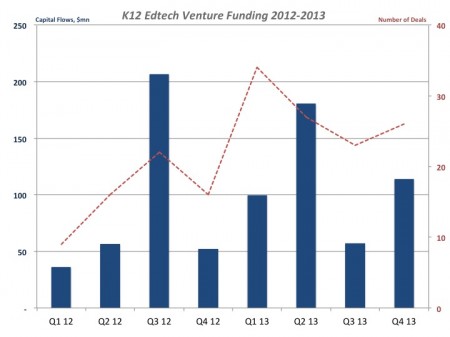

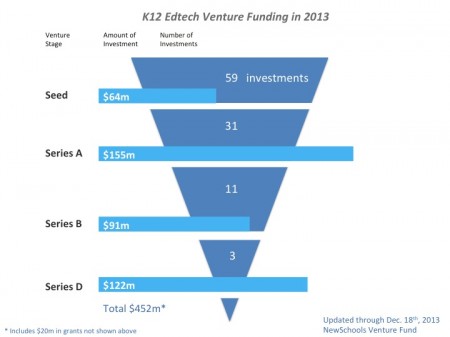

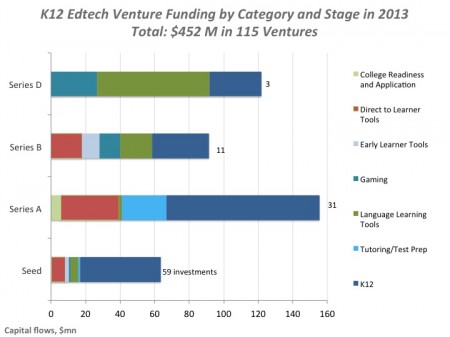

Venture investment in K12 education technology was up 6% in 2013 totaling $452 million. Over half of these investments were seed stage transactions mirroring the overall venture trend of increased financing from non-traditional sources (angels, super angels, micro-VC’s, incubators) at the seed stage. The NewSchools Seed Fund led and/or participated in nearly a quarter of the 59 K12 edtech seed investments in 2013. Here we share our 2013 analysis of K12 edtech venture funding. Please note that in this analyses we do not include companies exclusively focused on higher ed nor do we include corporate training – both categories represent relatively large VC funding sectors. Our focus is on companies serving the preK-12th demographic- both inside and outside of schools.

A few key trends:

-

Increase in both size and number of seed rounds. Last year, 34 companies were funded at the Seed stage and this year that number increased 74% to 59 investments. Meanwhile, round sizes continue to increase in order to extend runway to series A where investor expectations have expanded substantially (as Jeff Jordan notes, the series A round is the new series B round).

-

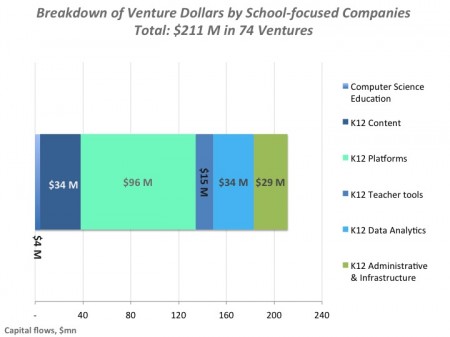

Education needs Big Data too. While the term data-driven instruction has been en vogue in education for 5+ years, the technology tools to extract, analyze and make use of that data have been crude and technically unsophisticated. As a result, data-driven instruction has been more aspirational than reality in our nation’s classrooms. This year, $34 million was invested in big data for K12, up from just $5 million last year. The influx of new technical talent into education, crossing over from other industries, is promising to build the quality of tools needed in K12.

-

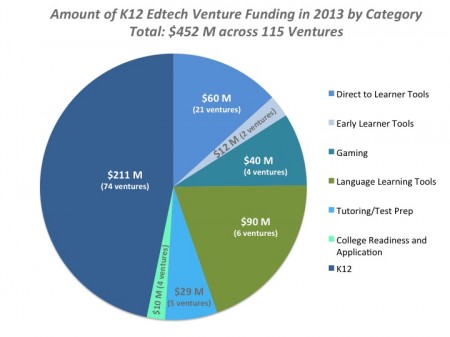

Language learning tools, with its large market opportunity, continue to attract later stage venture capital – $90 million in 2013. OpenEnglish and Voxy closed significant rounds of financing.

-

Coding is not just for silicon valley hackers. Companies focused on teaching computer science to young learners has garnered nearly $23 million in funding, up from just $1 million a year ago. We see this trend continuing as more schools integrate computer science into the school curriculum and states recognize computer science as a credit-bearing course.

-

The more “consumer-ish” education products stand a higher chance of getting funded in series A and up. In general, venture capital will take greater risk on consumer looking education products, especially those with compelling user engagement and growth. Fewer education enterprise products break-through with proven business models and traction, but when they do, scale-up or growth capital is available (e.g. Instructure – $30 million D round).

A quick note on categories:

Whereas last year there was a clearer delineation between companies servicing schools and those focused on consumers, we’re finding that line is growing more porous all the time. Consumer products are flowing into schools and visa versa.

A few notes on categorizations:

Direct to Learner: consumer applications that exist wholly outside of school with little to no footprint inside of schools. This category does not include companies that are adopted by teachers and monetized by parents. Primary user and payer is the consumer. e.g. Learnhive, Little Bits

K12: content, platforms and tools used in schools and/or adopted by teachers. Primary user may be teacher or student. These products could be monetized by schools, districts and/or parents. This category is growing quickly as schools rapidly integrate technology. e.g. Brightbytes, Class Dojo

Early Learner Tools: consumer applications focused on pre-kindergarten demographic. e.g. Kidaptive

College Readiness & Application: tools focused on preparation and application for college. e.g. Pathbrite

Tutoring/Test Prep: preparation for high stakes testing and/or individual tutoring. e.g. InstaEdu

Thanks to David Havens and Shauntel Poulson for feedback and guidance. The original data can be found here. Please send any updates you have to vmurali@newschools.org